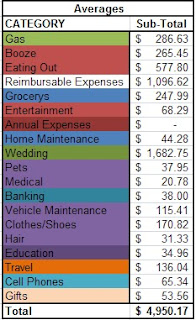

I have been looking forward to writing this post for the last few months, we've finally been able to review three months of spending patterns for Jordan and I since we combined our finances and started using our joint credit card. Several of my readers have commented that they thought our credit card budget/planned spending was high - and they weren't sure why. Seeings as Jordan and I have consistently blown the budget - I wasn't really sure why either.

There are a few trends that are glaringly obvious:

- We don't budget for all the categories we spend in

- We don't spend nearly what I thought we did/need to for groceries/cleaning house supplies

- Our 'planned spending' which is a bit of a catch fall is almost double!

- Our 'other' is ridiculous

We had actually intended for travel/education/wedding/annual expenses to just come from the planned spending or other categories, but I wanted to break it down further to really look at our spending. The gifts category I'm not so worried about budgeting for, because when we purchase gifts I just transfer the money from our ING gift account. The wedding fund is treated the same way, with moving money from our savings account to cover the expenditures.

Here is the spending summary in context with the budget:

I'd like to give a bit more context to the categories, so here is the list really broken down:

Our planned spending is dominated by booze, eating out, and entertainment (to a small degree).

Our other category includes pets (the fish), medical, vehicle maintenance, clothes/shoes, and hair cuts.

The education category includes parking for Jordan when he goes to school once a week, but this will need some padding soon when I go for my CHRP.

So, on average and not including gifts or wedding stuff (as described above) we have blown the budget by about $800/month

I don't think it's realistic to cut eating out and booze expenditures all together - but we certainly can try to cut back a lot in that area. Alone it's not enough. I'm also thinking we could try to drive my car more often then the truck because it's better on gas - but I'm not sure how much we will actually save doing that. The other thing that we could try to do is not buy clothes/shoes/vehicle maintenance all in the same month.

I would really love your honest thoughts - I've you're still reading. I'm looking for suggestions more then just 'don't buy so much beer' - but how to stick to the budget better when we're using credit cards and how to plan for clothes when their for work ect (not frivolous). If you want to tell me we spend too much on eating out - that's okay too :)

I wonder if you should have a "food" category which includes eating out and groceries. You two are spending $800-900/month on food.

ReplyDeleteMaybe your grocery budget was realistic - if you were to eat at home more! My DH and I spend about $500/month on food (groceries and eating out) and I think we certainly don't scrimp on groceries.

I think you probably do need to limit your eating out, if you want to cut your budget. There is nothing wrong with spending the amount you do, if you can afford it.

When we eat out and spend $30-40 at a time, I just think how we could have eaten for 4 days at home for that amount of money.

@Anon - I think that's a great suggestion. It would really show how much we're putting in our mouths... breaking it up makes neither one look as bad as it does combined.

ReplyDeleteWe havent begun Novembers spending as of yet due to our billing cycle. This will be updated... I got confused

ReplyDeletefood for thought (pun intended)

ReplyDeleteVehicle maintenance is an ugly devil that will always rear its head. With that being said it is hard to envision trying to plan how much something is going to cost. Jess and I both need Windshields. I (due to my career) can get this done for 175$ installed.

Seeing as we spend enough money on eating out as it is; If we have to spend money on repairs then we should use gift certificates that we get from Airmiles points on those months to help with the overall spending.

Also I think it would be good for us to track on psychical monthly spending so we know what we are buying month to month. Trying to remember what we bought and where from a spreadsheet is mind-boggling

What do ya'll think

I used to think we spent quite a lot on eating out (about 200 for two) but it doesn't look so bad. (Although now T is back in work he often buys food on his own dime). And we don't really socialise all that much.

ReplyDeleteI'm sceptical about saving much gas by changing the car you drive. I'm not sure how you budget your car expenses - is there kind of an ongoing 'fund' you contribute to and then pull out of? Or do you budget am amount each month and try to absorb any overage? (Really, 115 is NOTHING though!)

'don't buy so much beer'

ReplyDeleteJ/K

I think the first suggestion of keeping a closer track of the food expenses is a good one. Or even just try two weeks of eating at home and then compare how that budget is to a "normal" eating schedule. Two people eating in is a lot less expensive than two people eating out.

That obviously won't get you down $800. So I think a small reduction across the board is probably in order. Less beer, less eating out, less clothes. A little from here and there may make it all seem more reasonable.

I'm sure the "wedding" mentality helps the spending impulses though. =)

My best friend called to tell me she thinks we should try making beer again - it was a fairly inexpensive endevour and was a lot of fun. That way the cost of buying beer would perhaps go down.

ReplyDeleteThanks!

I can really see what you mean by you don't plan your expenditures

ReplyDeleteHave you thought about setting up a sheet of what you would like to buy: clothes, car stuff, maintenance on a sheet?

Like: January, need a new spring coat

February: Change oil in car

And so on, so you can delay purchases or figure out a schedule of where/when to buy items at their cheapest.

Maybe you could also do something like only 2 cans of beer a week each. Or set a limit, only going out ONCE a week with a $50 limit, rather than all the time in chunks

That food budget seems severely high for two people. My husband and I probably spend between $400-$500 on food each month. We rarely by alcohol and eat the majority of our meals at home. We only go to a sit down restaurant about once a month and we MAYBE do fast food once a week.

ReplyDeleteI also agree with Makky's Mom, I write out every dinner for the week. My husband eats at home every day for lunch and I bring my lunch to work. I pick up things for breakfast like one box of cereal and oatmeal and that seems to work.

Your "Other" budget seems to go over quite a bit. I'm really not sure what to tell you here except to just cut back spending. Best of luck!