Her timeline is vague (anywhere from 3 to 18 months), but it's in both our best interests to start to hammer out the eventual price. It's important so that we know if Jordan and I can actually afford to buy her home; because if not, we'll start looking at new builds (townhouses/condos).

it's a bit dark - but here is a picture:

So, our first step was to have a market assessment done. It's actually best if we get two done (us and her) to make sure that it's fair. The real estate agent we found came up with a recommended listing price range of $375,000 to $391,000.

Jordan immediately thought that the number was wayyyy to high. To give you a picture, the house has been lived in for 30 years by two chain smokers (now only one) and hasn't had a single reno/update done. My aunt, when she moves - wants to leave the place as is. Not only is she a smoker, but a bit of a collector (not quite hoarder-style, but she does have a lot of stuff). We anticipate required renovation costs to be between $65-80,000.

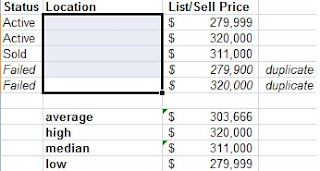

Upon going through the report, I've found that the majority of the homes in it have had lots of renovations including: finished basements, hardwood floor, new counter tops, new bathrooms, new kitchens etc. My Aunts doesn't have those things - it needs those things. I've summarize the report he gave us and found 3/29 listings to be close compartitives.

you'll notice right away there's two duplicates. I believe this is because they were listed and failed to see and then listed again at a later date.

So - if you look at the actual comparative homes, there's an average price of about $305K - which is much more reasonable (and actually my first gut response when thinking about how much I would pay was $300K). When we described the report to my grandfather (who has been a general contractor for nearly 40 years, if not longer) he thought about $290,000 sounded good.

Jordan feels that starting at $250,000 (because my aunt loooves to negotiate) would be good and then we can go through the report and suggest she still get her own done.

It gives us a great place to start and we are feeling pretty good about it.

Our next steps include:

- talking to my aunt

- talk about money

- talk about a timeline

- suggesting she get a second market analysis done

- get a bank assessment done

- to find out how much of a mortgage we could actually get for the property

- ramp up our savings

Its all coming together. But I would wait to see where she starts before low balling her.

ReplyDeleteIf the homes in the area have renos and things like hardwood floors and finished basements etc, what are they selling for? Getting those neighbourhood comparables are important too. It's the start of an exciting adventure for you.

ReplyDelete@ Mom - we certainly don't want to 'low ball' her - but are now very confident that the price should be near (if not below) $300K. I think it would be in everyone's best interest though - to see where she's at before putting a number out there.

ReplyDelete@Jolie - for places that have had reno's the price is around $350-$450 - depending on how extensive the reno's are.

New builds in the are go from $500K-$750.

Wow how exciting that things are starting to come together. I don't think you are low balling her, since you would need to sink money into renovations! Hope you agree with a price that you and your aunt are comfortable with.

ReplyDeleteDealing with family can be difficult to buy/sell with....things always become personal...I hope it works out because that would be a sweet first place

ReplyDeleteWhat has the City assessed the value at for property taxes?

ReplyDeleteFurther to my question above, if you don't know what the property tax assessment is, you can find out by using this link:

ReplyDeletehttp://dmzwww2.gov.calgary.ab.ca/fairshare/script/asmt_SearchOptions.asp

Choose "search by address"

@ Anon - I have used the property tax assessment table many times. As the city's market is every changing, the assessment has been going down every year.

ReplyDeleteIt's currently $420,000.

Keep in mind, it's in the city's best interest to have a high number here - because it means they get to collect more taxes. They also don't actually look at the home, just the location.

Are comparable homes in your area priced similarly? Even for our area (NYC suburbs), the high estimate of $350K-plus is a lot of moolah for a ranch home that looks like it's 2 BRs (just my guess!).

ReplyDeleteI do agree with Matt that it could be difficult to deal with family in this case. Unless you both make out well on the deal, perhaps you could check out other homes. Either way, good luck!

@ Rainy - there was only one comp that actually sold in the area (see the image of my spreadsheet in post above) and it sold for $311K - even that was move in ready...my aunts is not, it needs to be cleaned.

ReplyDeleteThere are plenty that have sold for around $400-$500 but they are not comparable homes (lots of updates)

Why on earth would you want to buy your Aunt's house?!?! The market is flooded with resale homes. If I were you I wouldn't even think of buying/selling property from/to family members. No mattter how it all goes down, one of you is going to feel that you were taken advantage of.

ReplyDelete@ Anita - I'm not sure I agree with that, but I wonder if you have had a bad experience?

ReplyDeleteMy Great Aunt really wants us to have her home, and the neighborhood is perfect for us. It needs a lot of repair/renovation - so we can really make it our own space.

Plus, her yard is twice the size of a new build generally is - and we're really looking forward to some more green space.

I think that if either one of us doesn't feel good about the end price, the deal won't go through. We've talked about that with her quite a bit - that if the price isn't right, we won't buy - but that 'that' scenario is okay. We will still help her sell her home when she's ready.